Understanding Stablecoin Activity: Dashboard for Settlement Asset Ecosystem Transparency

How Allium built infrastructure for real-time visibility into activities of stablecoins, showcased at the Singapore FinTech Festival 2025

The Market Intelligence Challenge

As stablecoins have grown to over US$300 billion in market cap, public sector entities working to understand digital asset markets face a fundamental challenge: how do you gain visibility into assets that operate 24/7 across multiple blockchains with transaction finality measured in seconds, not days?

Digital assets operate across dozens of blockchain networks with distinct protocols and economic models, processing billions in daily stablecoin volume. The fundamental challenge lies in synthesising real-time activity across this fragmented landscape - from established networks like Ethereum to emerging Layer 2 solutions and new blockchain architectures that launch regularly. Without this holistic, cross-chain perspective, assessments may miss critical interconnections and emerging patterns spanning the entire digital asset ecosystem.

Understanding stablecoin market development requires real-time visibility into transaction flows, user activity patterns, and aggregate volumes - both domestically and globally. It requires the ability to distinguish compliant issuers from the broader market. And it requires infrastructure that can keep pace with blockchain-native settlement speeds.

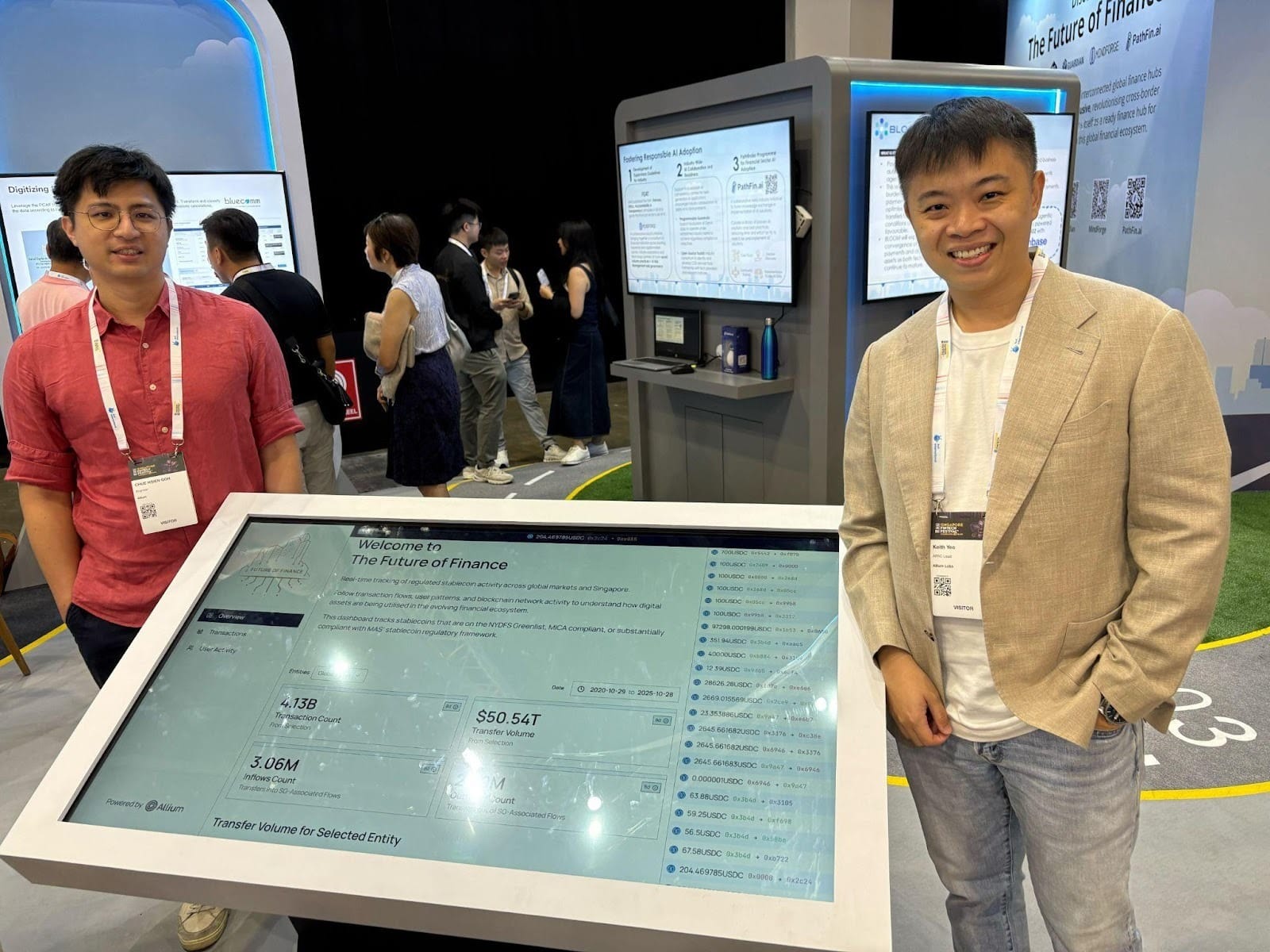

Allium built a dashboard to explore this visibility gap and improve understanding of existing stablecoin activity across blockchain networks, which was showcased at the MAS Future of Finance pavilion during the Singapore FinTech Festival 2025.

What Was Built

At the Singapore FinTech Festival 2025, a stablecoin activity dashboard was showcased at the MAS Future of Finance pavilion. The dashboard demonstrates continuous visibility into the activities of a subset of stablecoins with three core capabilities:

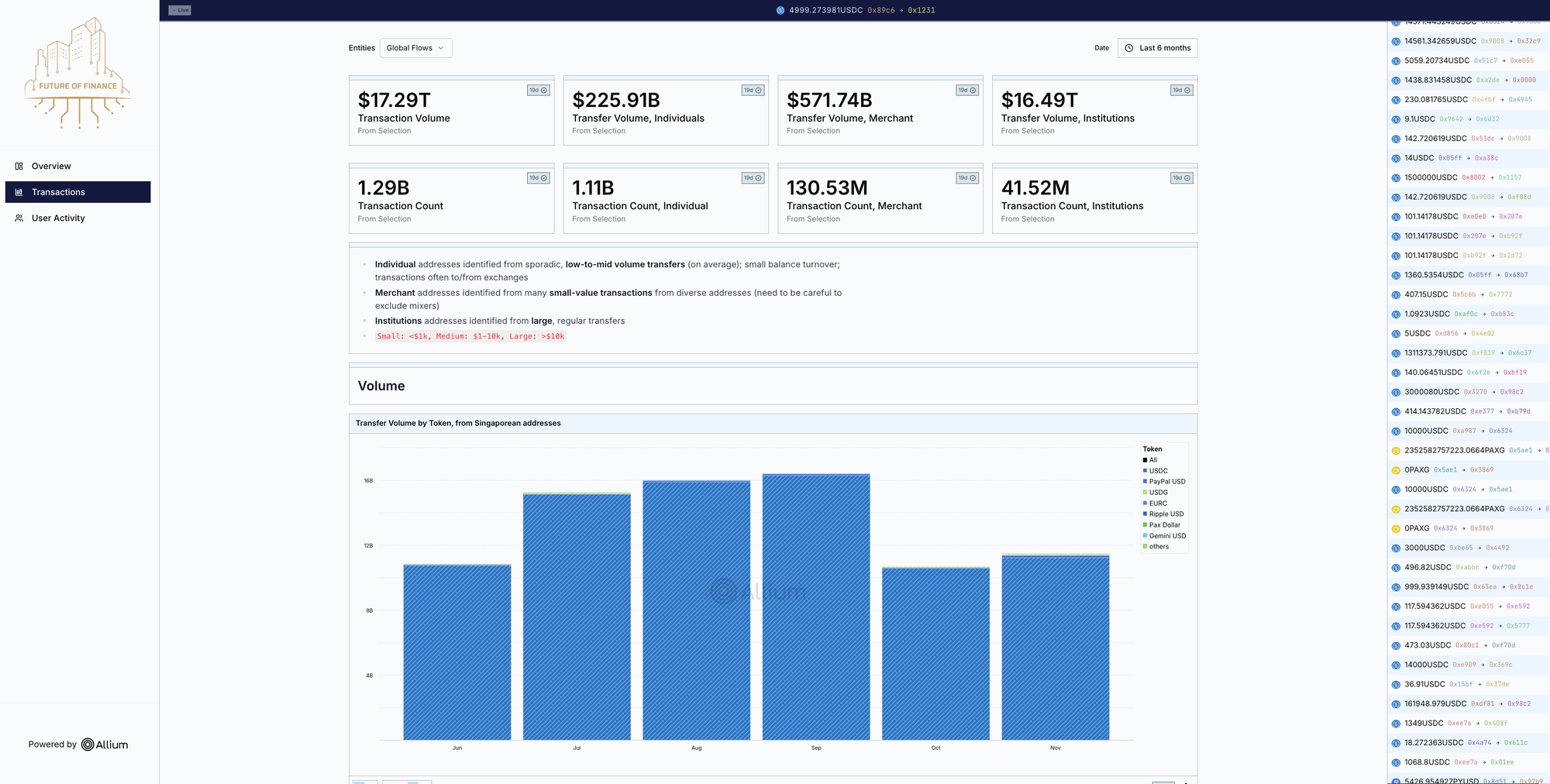

1. Transaction Flow Analysis by Use Case

The system categorizes stablecoin transactions by economic purpose - cross-border payments, merchant settlements, remittances, treasury operations, and institutional transfers. This helps understand how stablecoins are being used within and across jurisdictions.

2. User Activity Patterns by Category

The dashboard tracks activity across user segments: retail consumers, merchants, financial institutions, and corporate treasuries. This segmentation enables understanding of adoption patterns and use case evolution across different market participants.

3. Aggregate Volume Monitoring (Global and Domestic)

The dashboard showcases the potential to view both Singapore-specific stablecoin volumes and global activity for context. This dual perspective illustrates how such infrastructure might help improve understanding of market trends and activity patterns.

Specifically, the dashboard focuses on an initial set of stablecoins that are either MiCA compliant, substantively compliant with the upcoming MAS' single-currency stablecoin framework, or included in the NYDFS Greenlist.

Technical Infrastructure Enabling Ecosystem Transparency

Building real-time visibility infrastructure for blockchain-based assets requires solving several technical challenges that traditional financial market intelligence systems don't face:

Multi-Chain Data Aggregation

Stablecoins operate across Ethereum, Polygon, Solana, Arbitrum, and other blockchain networks. The infrastructure must normalize data from chains with different data models, transaction structures, and finality mechanisms into a unified view.

Real-Time Processing at Scale

Blockchains produce continuous streams of transactions. The system must process, categorize, and aggregate millions of transactions in real time to provide current visibility - not yesterday's snapshot.

Transaction Classification and Enrichment

Raw blockchain data shows wallet-to-wallet transfers. Understanding ecosystem development requires knowing what those transfers represent: Is this a merchant payment? A cross-border remittance? An exchange deposit? The infrastructure must decode smart contract interactions and enrich transactions with business context.

Compliance-First Data Filtering

Not all stablecoins meet established compliance standards. The system must identify and track only those tokens that meet specific criteria, filtering out hundreds of non-compliant or unregulated alternatives.

Verification and Data Quality Assurance

For meaningful ecosystem analysis, data accuracy is essential. The infrastructure includes continuous verification to ensure data quality and proper transaction classification.

Allium built the dashboard, leveraging its blockchain data infrastructure to make this level of visibility technically feasible - from initial ingestion through final enrichment.

Singapore's Approach to Responsible Stablecoin Ecosystem Development

MAS has consistently taken a principles-based approach to digital asset ecosystem development. For stablecoins, this means supporting an environment where compliant issuers can operate with clarity around reserve backing, redemption rights, and operational standards.

At the baseline, MAS Digital Payment Token (DPT) regulatory framework regulates services relating to DPTs (including stablecoins) for risks relating to ML/TF, tech, consumer harm and business conduct. MAS regulatory approach towards stablecoin, is a step-up framework from the baseline DPT regime, and seeks to ensure a high degree of value stability for stablecoins regulated in Singapore. Those seeking the "MAS-regulated stablecoin" designation must meet requirements on value stability under the Single Currency Stablecoin (SCS) framework. The SCS framework finalised in the 2023 response to consultation paper currently exists as regulatory guidance that sets out strict standards for reserve backing, capital requirements, redemption processes, and transparency for high-quality stablecoins.

MAS is now working on legislative amendments to the Payment Services Act to formalise the framework. This legislative process will codify the existing 2023 framework into formal law, providing stronger legal certainty and enforcement mechanisms while maintaining the same core principles of ensuring value stability and consumer protection that distinguish regulated stablecoins from volatile crypto assets.

What Modern Stablecoin Ecosystem Infrastructure Looks Like

The dashboard demonstrates what transparency infrastructure needs to deliver for understanding blockchain-based financial instruments:

Real-time, not retrospective. Traditional quarterly reporting provides limited visibility into assets that settle instantly and operate continuously. Current data enables better understanding of ecosystem evolution.

Use case-driven, not just volume-based. Knowing that US$10 billion in stablecoins moved through a jurisdiction matters less than understanding whether those flows represent consumer payments, institutional treasury operations, or other use cases.

Cross-border in nature. Stablecoins usage can transcend geographical borders. Understanding ecosystem development requires visibility into both domestic activity and its global context.

Compliance-scoped. Attempting to track every token is neither feasible nor useful. Focus must remain on compliant, systemically relevant issuers.

Built on verified data infrastructure. Understanding ecosystem development requires trustworthy data. The underlying infrastructure should be able to support accuracy at scale.

Implications for Public Sector Entities Supporting Digital Asset Ecosystems

The dashboard demonstrates several considerations for other jurisdictions and organisations working to understand stablecoin ecosystem activity.

Assess regulatory status of the stablecoin. Build infrastructure focused on tokens meeting established standards first. Expanding to broader ecosystem monitoring is easier than trying to cover everything from day one.

Leverage specialized data infrastructure. Blockchain data infrastructure is complex and rapidly evolving. Organizations should focus on their core mandates while working with technical infrastructure providers where appropriate.

Design for real-time from the beginning. Retrofitting quarterly reporting systems for real-time visibility is harder than building with that requirement upfront.

Emphasize transaction context over raw volume. Understanding use cases, user segments, and economic flows provides more actionable insight than aggregate transaction counts.

As more jurisdictions, including the United States, European Union, and other G20 nations, develop approaches to digital asset ecosystems, the need for transparent, real-time visibility infrastructure continues to evolve. The showcase at the Singapore FinTech Festival demonstrates that building such infrastructure is technically feasible and could provide operational value for improving understanding of stablecoin activity and market dynamics.

Disclaimer: The dashboard was showcased at the MAS Future of Finance pavilion during the 10th Singapore FinTech Festival to demonstrate the infrastructure needed for understanding stablecoin ecosystem activity. Allium provided the blockchain data infrastructure enabling real-time multi-chain data aggregation, transaction enrichment, and compliance-focused filtering. The dashboard does not reflect MAS' views on what constitutes or will constitute a regulated stablecoin, either currently or in future regulatory determinations.