Onchain Execution: How Institutions Are Trading in DeFi Markets

A joint perspective from Uniswap Labs and Allium on the infrastructure enabling institutional DeFi adoption

The institutional conversation around trading onchain has shifted from "if" to "how" over the past 18-24 months. What was once viewed as experimental infrastructure for retail traders now represents a strategic venue for institutional execution—one that offers transparent liquidity, atomic settlement, and competitive pricing.

The shift to onchain trading has been enabled by fundamental improvements across custody, compliance, and execution infrastructure. Solutions like Fireblocks and Anchorage Digital now provide institutional-grade custody that integrates natively with DeFi protocols. Trading platforms have evolved to offer unified, API-driven access that fits existing institutional workflows. The result: institutions can now execute onchain without disrupting operational processes or compromising on the standards they expect from traditional venues.

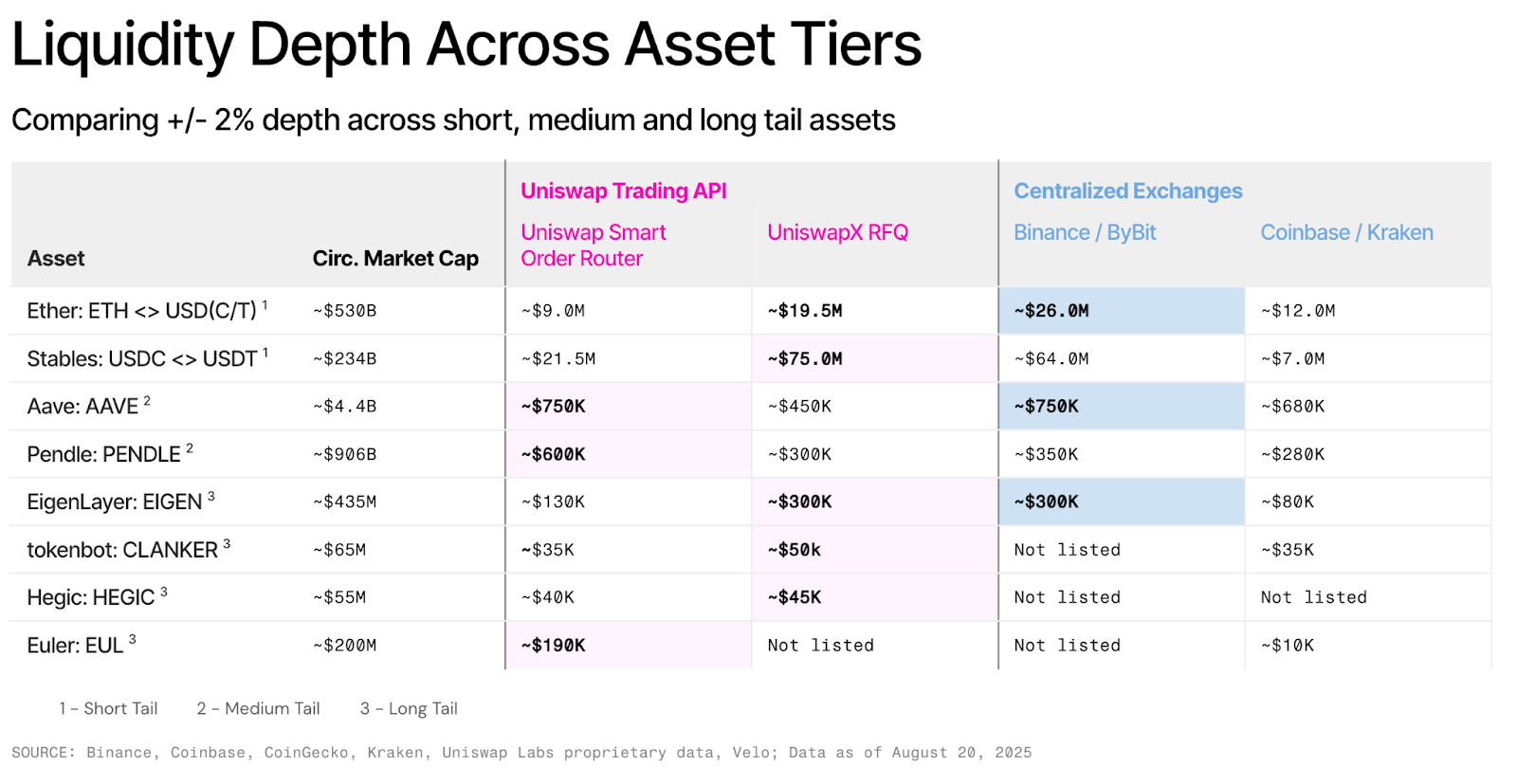

Liquidity Depth Rivaling Centralized Exchanges

Institutional adoption requires institutional-grade liquidity depth. Over the last 2 years, decentralized venues such as Uniswap now provide exceedingly competitive liquidity depth across short-tail, mid-tail, and long-tail assets.

For stablecoin swaps and blue-chip pairs, Uniswap Protocol’s liquidity is comparable with leading Centralized Exchanges. As the asset mix grows to include mid and long-tail assets, Uniswap often outperforms major CEXs, oftentimes having substantial liquidity on pairs that are not even listed on major exchanges.

This has become a significant development with onchain markets: new assets now achieve meaningful onchain depth before centralized listings. Decentralized venues have become the primary location for price discovery on emerging tokens—a reversal from historical patterns where CEX listings drove liquidity formation.

Uniswap Trading API: Institutional-Grade Trading Tools

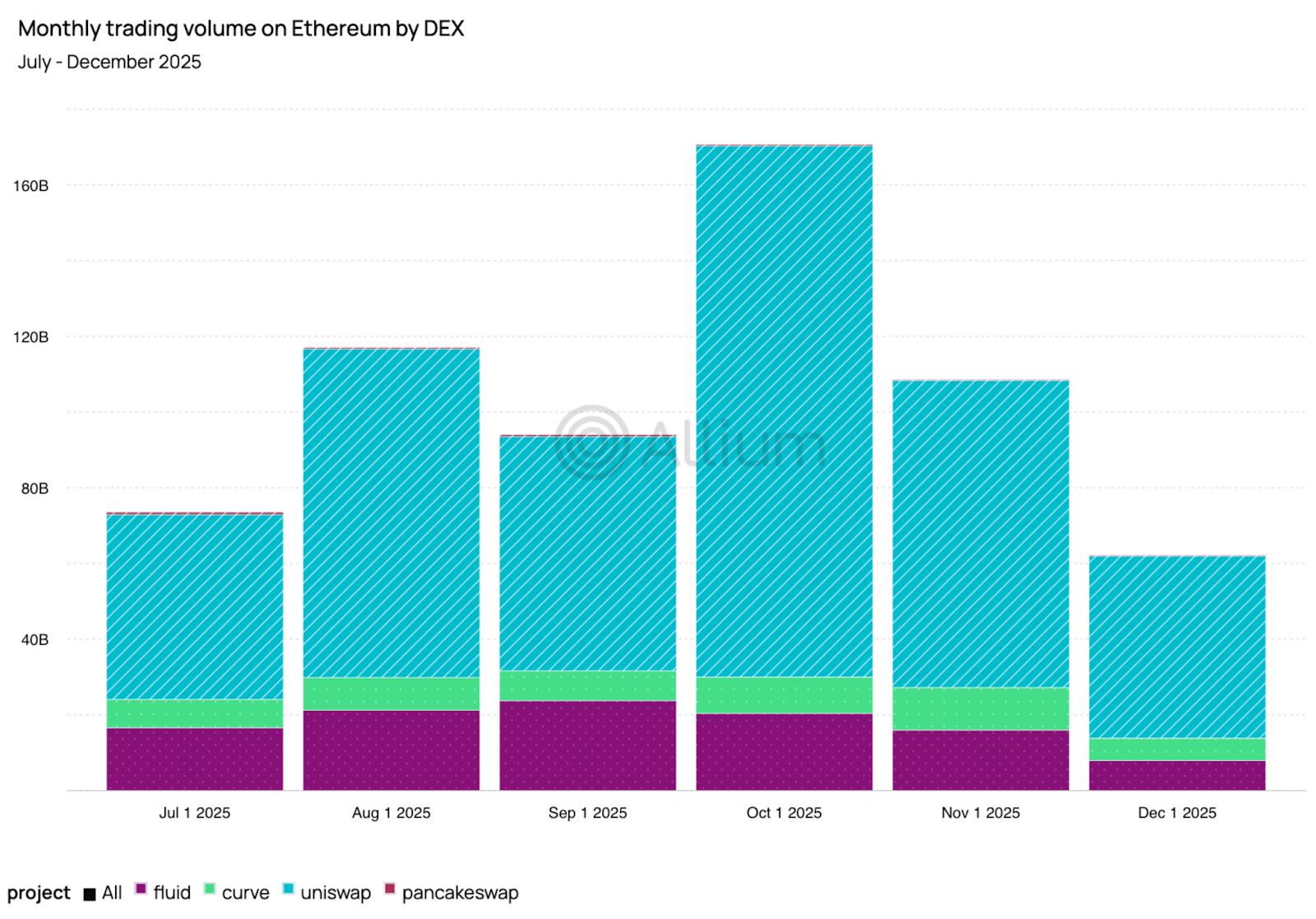

Throughout 2025, DEX trading volumes have steadily increased after correcting from a memecoin trading frenzy in January, with the Uniswap Protocol commanding a significant portion of overall trading volume.

Uniswap Labs’ Trading API gives institutions a direct rail into onchain markets, abstracting away protocol fragmentation and infrastructure overhead to provide efficient swap routes.

A single REST API allows unified routing across Uniswap v2, v3, v4 protocols and also sources liquidity from UniswapX, a continuous RFQ system that aggregates quotes from 25+ professional market makers, aggregating onchain and offchain liquidity sources to give API integrators the ability to give swappers better price outcomes, automatically.

Delivered as REST endpoints built on the same stack that powers Uniswap’s own applications, the Trading API slots cleanly into existing workflows and provides a unified, reliable path that yields deeper liquidity and more competitive pricing than any single exchange can provide.

Transaction Costs Are Increasingly Competitive

Total transaction costs for onchain execution are exceedingly more competitive, when compared to CEX and OTC alternatives.

Onchain execution consists of three components: 1) Gas Fees, 2) Slippage, and 3) Additional Trading Fees.

Each has improved substantially in 2025.

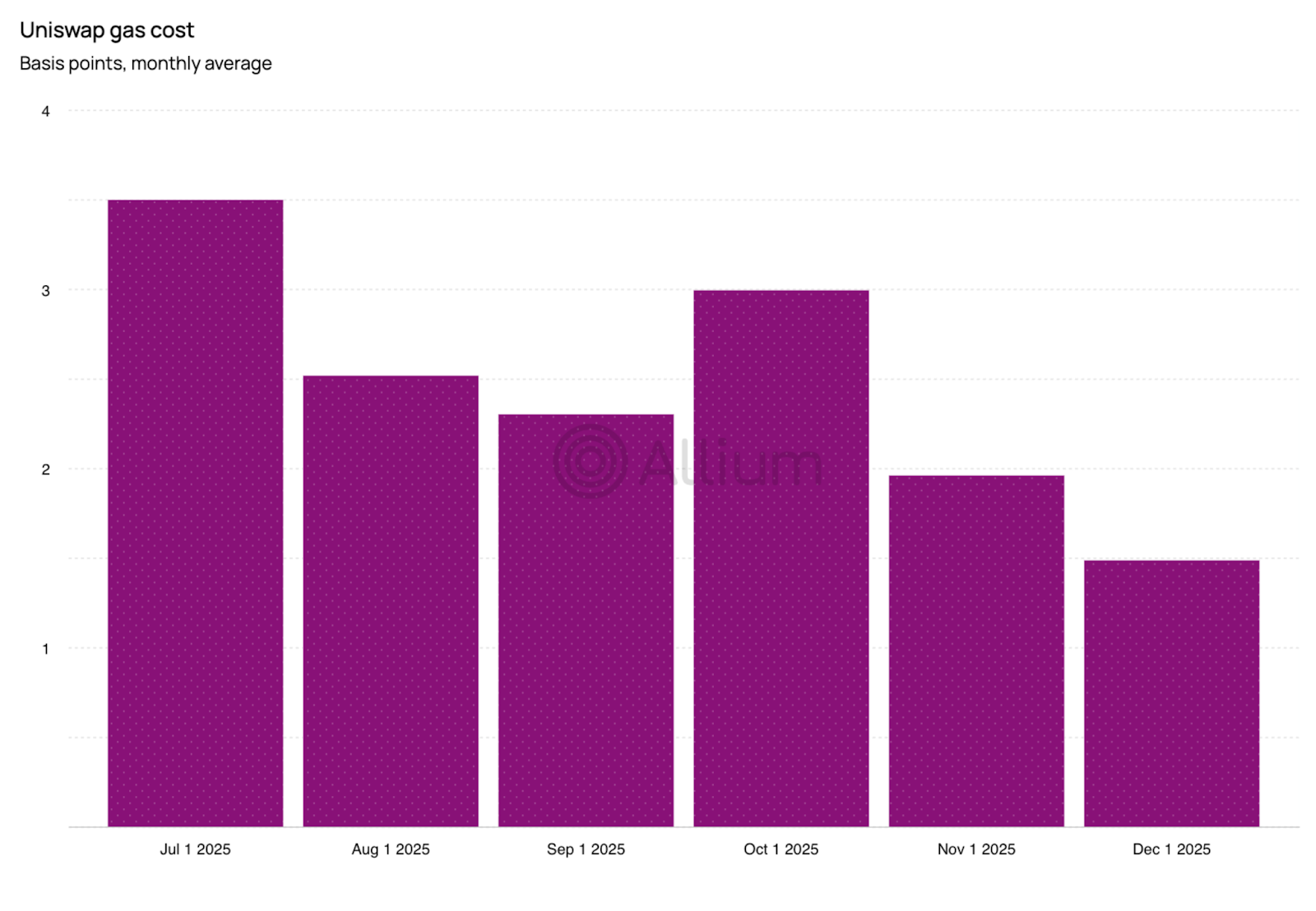

1) Gas costs on Uniswap have declined throughout the year, starting at approximately 6 basis points in January and falling to around 1 basis point by December. This reduction reflects both Ethereum's scalability improvements and increased adoption of Layer 2 networks where Uniswap operates.

→ Conclusion: For institutional-size trades, gas costs now represent a negligible fraction of total execution costs.

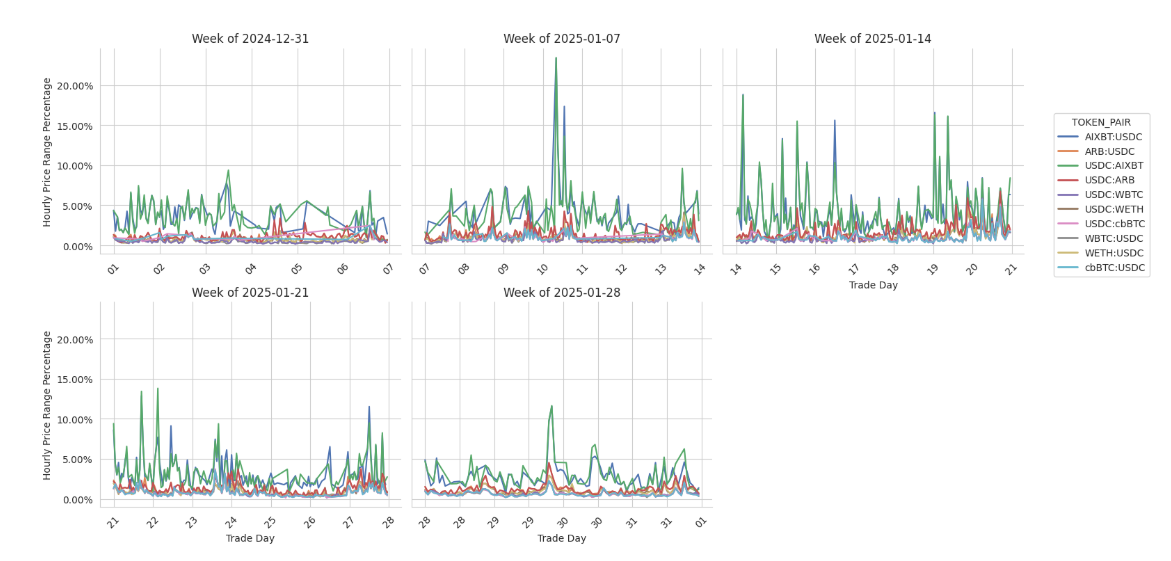

2) Slippage on high-liquidity pairs on Uniswap remains minimal. Even during the highest DEX trading volumes in January 2025, hourly price ranges for pairs like USDC-WETH stayed under 5% even during volatile periods, with many hours showing sub-1% ranges.

→ Conclusion: For large institutional trades on major pairs, price impact is comparable or better than what some centralized exchanges can offer.

High liquidity trades see minimal slippage even in volatile markets

The first weeks of 2025 saw a sharp rise in on-chain price volatility, following relatively stable conditions in late December. This increase was concentrated in a small number of lower-liquidity and memecoin-linked trading pairs, which experienced large hourly price swings and frequent volatility spikes.

In contrast, high-liquidity pairs such as USDC:WETH and USDC:ARB remained stable throughout the same period, with hourly price ranges generally staying below 5% even during market stress. The chart highlights that elevated market volatility did not translate into uniformly poor execution—rather, its impact depended heavily on liquidity depth and the specific assets being traded.

3) Additional Trading Fees (where applicable) In addition to gas costs and slippage, trading fees are the third component that determines total execution cost. How these fees are set–and who controls them–creates a material difference between onchain execution and centralized alternatives. Uniswap Labs does not impose any additional trading fees for its Trading API. Instead, the Uniswap Trading API gives integrators direct control over monetization: integrators can choose to offer swaps to end users at 0 bps, or set their own nominal swap fee. Fee mechanics are explicit and transparent – no maker/taker schedules, no volume-based fee tiers, no hidden spread markups, and no subscription pricing in exchange for lower fees.

By contrast, CEX and OTC alternatives typically layer in additional trading fees ranging from 10-150bps, often through opaque schedules or embedded spreads, resulting in worse execution for end users.

→ Conclusion: When integrators use Uniswap’s Trading API and set their swap fee to 0 bps, the remaining costs of onchain execution are gas fees and slippage only. In liquid markets, this drives total all-in trading costs into the 0-15 bps range – materially below centralized alternatives.

The difference isn't just absolute cost, but also transparency. Onchain execution makes every component visible: gas costs, protocol fees and slippage. Institutions can verify their true cost basis and audit execution quality in real time.

Centralized venues and OTC desks often operate with blended fee opacity—tiered maker/taker rates, funding fees, withdrawal costs, and spreads that vary by relationship and volume. Verification requires trusting the counterparty's reported metrics. Onchain execution eliminates this information asymmetry.

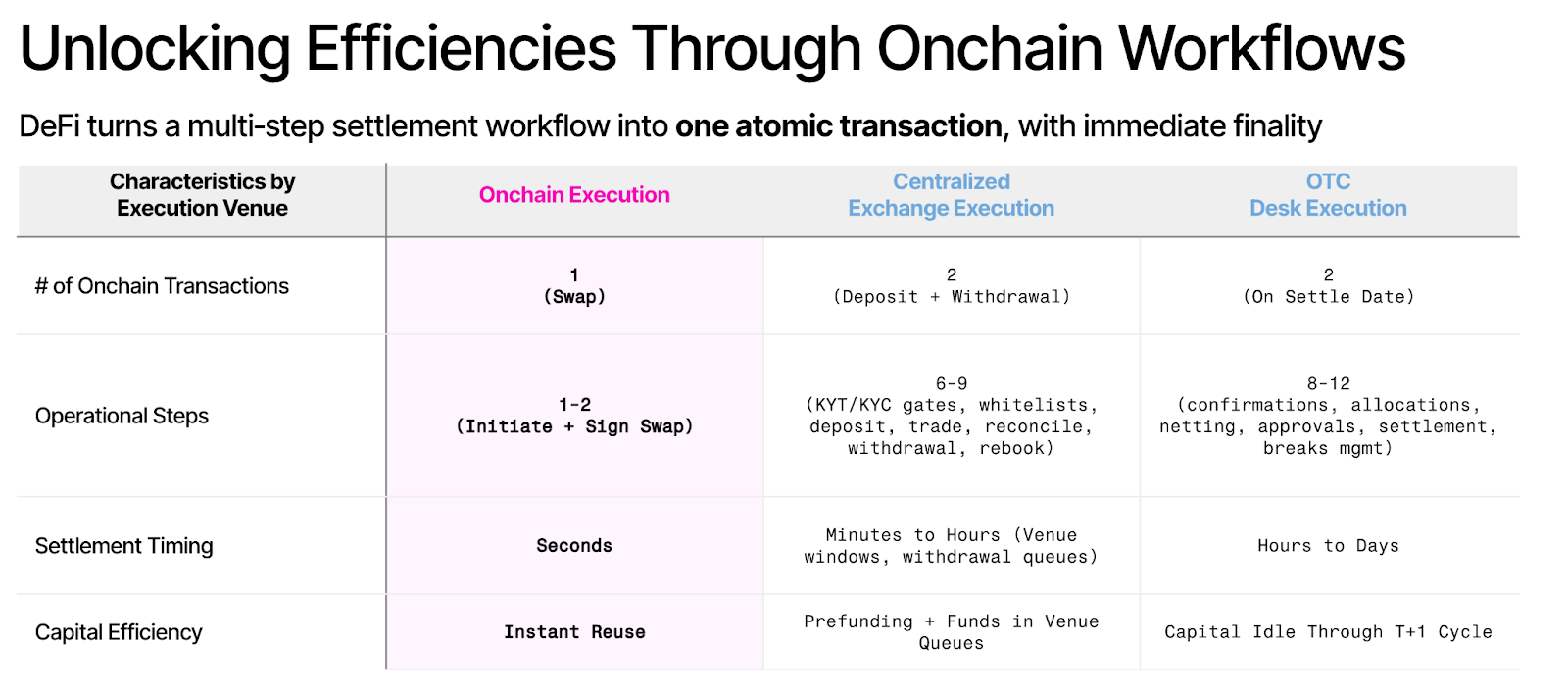

Onchain Execution Reduces Operational Complexity

The operational advantage of onchain execution becomes clear when comparing settlement workflows:

Moving trading operations onchain reduces a workflow of 6+ operational steps to a single atomic transaction while also eliminating prefunding requirements, withdrawal queues, and settlement windows.

Wrapping Up: Onchain Infrastructure Is Production-Ready

Institutional trading desks across the world are increasingly moving operations onchain.

Onchain execution complements existing liquidity relationships by providing:

- Wider breadth of asset selection

- Transparent, verifiable execution data

- Atomic settlement that eliminates settlement delays and multi-step trading workflows

- Non-custodial workflows that reduce counterparty risk

The tools exist today and are enterprise-ready: custody solutions supporting DeFi natively, trading APIs providing unified access to decentralized liquidity, and data infrastructure making onchain activity transparent for compliance and analysis.

Learn More – Trade Onchain

- Learn more about the Uniswap Trading API and get in touch with Eli Engelman, Business Development Lead.

- Learn more about Allium's institutional data infrastructure