How Awaken built crypto tax software for protocol-level complexity

Andrew Duca on handling crypto taxes for Solana LPs, Bitcoin Runes, and the long tail of onchain activity

Crypto tax software faces a structural coverage challenge. Products built between 2017 and 2021 optimized for a specific market structure: centralized exchange trading, simple token swaps, and established protocols with stable transaction formats.

By 2023, the landscape had shifted. Users were providing liquidity on Meteora, trading Runes and Ordinals on Bitcoin, moving between L2s, and interacting with protocols that launched within the prior six months. When these users filed taxes, they encountered missing transactions, incomplete cost basis calculations, and unsupported protocols.

Awaken addressed this gap. Founded by Andrew Duca in 2022, the platform grew to over 30,000 users by focusing on transaction types that require deeper protocol integration. The thesis: as onchain activity increases in complexity, tax infrastructure needs corresponding technical depth.

"I think the market in the future is going to be onchain. Spot volumes have moved onchain. Perpetuals are slowly moving onchain. Prediction markets are onchain. These are trends that are going to keep happening. And so I want to build products for people that actually use blockchains." Andrew Duca, Founder & CEO, Awaken

Awaken's technical scope

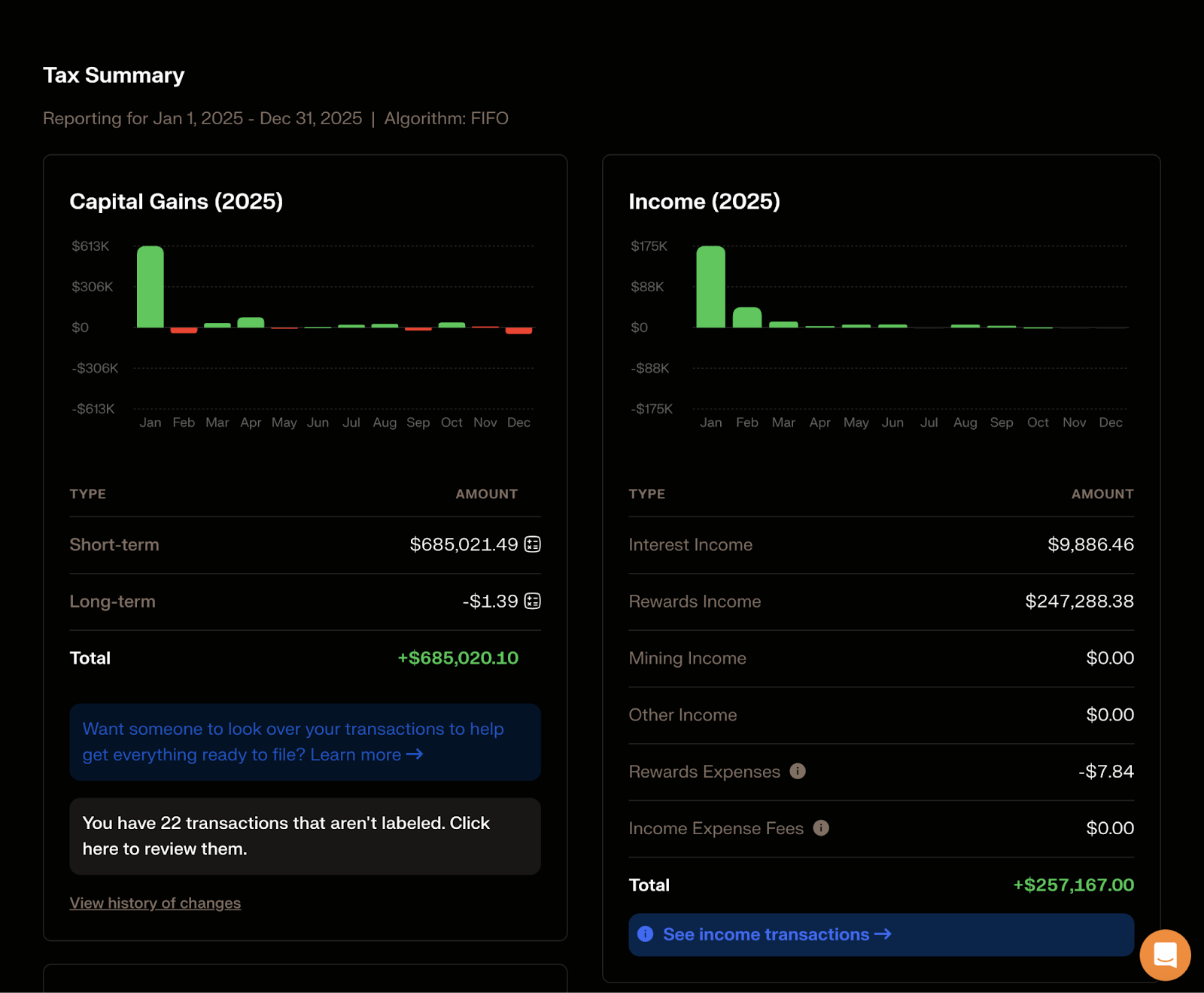

Awaken connects to wallets across dozens of chains, imports transaction history, calculates cost basis, and generates tax filing reports. The differentiation lies in protocol coverage depth.

Rather than just adding chains at the surface level, Awaken builds integrations for transaction types that create tax accounting complexity:

- Liquidity providing - deposits, withdrawals, fee accrual, impermanent loss calculations

- Bitcoin Runes, Ordinals, and BRC-20s - asset classes that emerged in 2023-2024

- Solana DeFi protocols - decoded event data for Meteora, Jupiter, and Marginfi

- Continuous syncing - real-time data for enterprise clients requiring year-round reconciliation

This approach targets transaction types other products deprioritize due to technical complexity, limited market size, or recent emergence.

Technical implementation

Awaken's architecture handles three core functions:

1. Wallet connection and transaction retrieval

Users connect wallets across supported chains. Awaken retrieves full transaction history, including LP positions, NFT trades, cross-chain bridging, and airdrops.

2. Cost basis calculation with gap detection

The cost basis engine processes transactions to determine capital gains, losses, and taxable income. The system identifies incomplete data: if cost basis cannot be calculated for a transaction, it flags missing historical records.

3. Tax form generation

Users export IRS-compliant forms (8949, Schedule D) or formatted reports for tax preparers. Enterprise clients maintain continuous syncing for ongoing reconciliation.

"We're uniquely positioned to tell if we have all the data. If there's missing cost basis, it means we do not have all of it. A wallet app has no idea if they have everything - they don't have a cost basis engine to check." Andrew Duca

Distribution through protocol coverage

Awaken's focus on complex transaction types functions as a distribution mechanism. Users with significant DeFi activity tend to be well-connected within crypto communities. When Awaken adds support for protocols like Meteora LP positions or Bitcoin Runes, these users recommend the product within their networks.

Andrew describes this as "hub and spoke distribution": serve users with complex needs, and they drive adoption through their social graphs.

This mechanism drove growth from several thousand users in 2023 to over 30,000 in 2024, representing 3-4x annual compounding.

"Liquidity providing is probably the most painful thing to do taxes on. You have deposits, withdrawals, fees, impermanent loss - all these different things. We didn't have a solution for this. But because of the data we could access, we could support Meteora, which is huge on Solana. That helped us get a lot of users." Andrew Duca

The approach also established trust signals. In Awaken's first tax season, Andrew personally resolved 600 user-reported issues, responding to bug reports, writing fixes, and deploying updates within the same day. This responsiveness built early reputation that enabled competition against better-capitalized incumbents.

Data infrastructure requirements

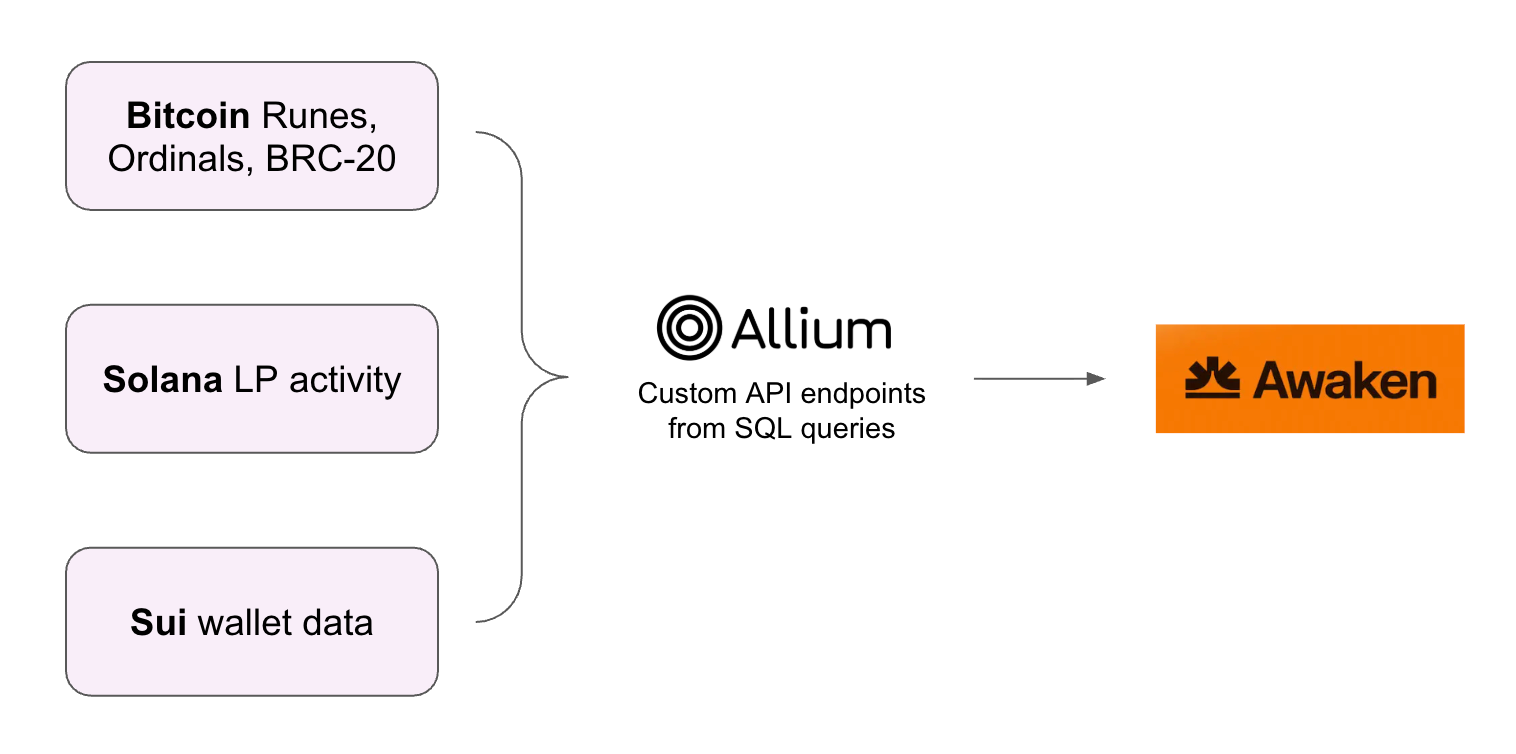

When Awaken launched in 2022, the team evaluated data providers against specific requirements: decoded transaction data for Bitcoin Runes, Ordinals, and BRC-20s; parsed Solana events for protocols like Meteora and Jupiter; coverage for chains like Sui where reliable indexing was limited; transaction detection across chains to trigger wallet syncing.

Awaken had previously integrated three data providers that subsequently ceased operations, creating engineering overhead to rebuild integrations. Business sustainability became a selection criterion alongside technical coverage.

Allium provided the required infrastructure:

- Bitcoin Runes, Ordinals, and BRC-20s - structured data for asset types that emerged in 2023-2024

- Solana decoded events - LP activity on Meteora, trades on Jupiter, and other DeFi protocols

- Sui support - when Awaken evaluated available block explorers, coverage gaps existed; Allium addressed them

- Transaction detection - Awaken uses Allium across most chains to determine when wallets require syncing

The evaluation considered coverage breadth, implementation timeline, and business sustainability as primary factors.

"We've built on top of three different data providers who shut down. I'm very hesitant to use anyone unless I think they actually have a business. I actually like that Allium charges what they do - it tells me this is a real business that's going to be around." Andrew Duca

Response time affects Awaken's ability to support new protocols as they launch. When the team requires new data fields or types, Allium implements updates within days.

Enterprise client expansion

Awaken is expanding from individual users into enterprise clients, who now use Awaken for continuous crypto accounting throughout the year rather than annual tax preparation exclusively.

As crypto finance moves further onchain, demand for accurate, comprehensive transaction data increases. Awaken positions itself as accounting infrastructure for this market evolution.

"Any financial system needs accounting. And accounting needs good data. These are bedrock pieces - if we want to compete with traditional finance, we need all of that.” Andrew Duca

Awaken is available at awaken.tax. Follow Andrew at @big_duca.

Data for crypto accounting or reconciliation infrastructure Contact us.